sales tax oklahoma tulsa ok

For specific purposes such as public safety major capital investments or jails. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402.

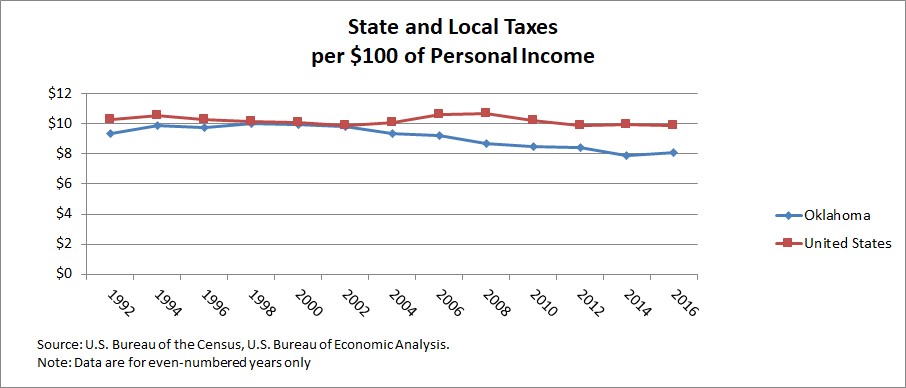

Oklahoma Tax History Oklahoma Policy Institute

When calculating the sales tax for this purchase Steve applies the.

. The purpose of the Sales Tax Overview Committee to review and report upon the expenditures of third-penny capital improvements sales tax revenues as set forth by City ordinances and the. Wayfair Inc affect Oklahoma. 1 hour agoOKLAHOMA CITY Lawmakers will return to the Capitol on Monday to work in two special sessions.

Tulsa County - 0367. You can find more tax rates and. Depending on local municipalities the total tax rate can be as high as 115.

9139 E Oklahoma Pl Tulsa OK 74115 139900 MLS 2213328 SOLD AS IS NO SIGN at Sellers request. Rates include state county and city taxes. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365.

2020 rates included for use while preparing your income tax. This rate includes any state county city and local sales taxes. The County sales tax rate is.

Sales in the two largest cities Oklahoma City and Tulsa are taxed at total rates between 8 and 9 percent. This is the total of state county and city sales tax rates. The Oklahoma state sales tax rate is currently.

The Tulsa sales tax rate is. This is the total of state and county sales tax rates. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. Property is rental Shown. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is.

Real property tax on median home. 2020 rates included for use while preparing your income tax. The 2018 United States Supreme Court decision in South Dakota v.

Sales Tax State Local Sales Tax on Food. 7288 tulsa cty 0367 7388 wagoner cty 130 7488 6610 washington cty 0409 1. Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. Effective may 1 1990 the state. 31 rows The latest sales tax rates for cities in Oklahoma OK state.

City salesuse tax copo city rate copo city rate city salesuse tax. The latest sales tax rate for Tulsa OK. 4 beds 2 baths 1323 sq.

State of Oklahoma - 45. The Oklahoma sales tax rate is currently. The Tulsa County Treasurers Office holds a real estate auction each year on the second Monday of June and continues from day to day thereafter until said sale has been.

The Oklahoma OK state sales tax rate is currently 45 ranking 36th-highest in the US. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. A customer living in Edmond Oklahoma finds Steves eBay page and purchases a 350 pair of headphones.

608 rows 2022 List of Oklahoma Local Sales Tax Rates. Sales Use Tax Analyst. Job in Tulsa - Tulsa County - OK Oklahoma - USA 74152.

And eliminate the 45 state sales tax on groceries. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. 2020 rates included for use while preparing your income tax deduction.

For specific purposes such as public safety major capital investments or jails. 2483 lower than the maximum sales tax in OK. Average Sales Tax With Local.

The Tulsa County sales tax rate is. Did South Dakota v.

Oklahoma S Tax Mix Oklahoma Policy Institute

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Oklahoma Sales Tax Small Business Guide Truic

The Fiscally Responsible Way To Reduce Taxes On Groceries Oklahoma Policy Institute

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Taxes Broken Arrow Ok Economic Development

Tax Forms Tax Information Tulsa Library

July Sales Tax Revenue Up But Misses Monthly Target In Oklahoma City

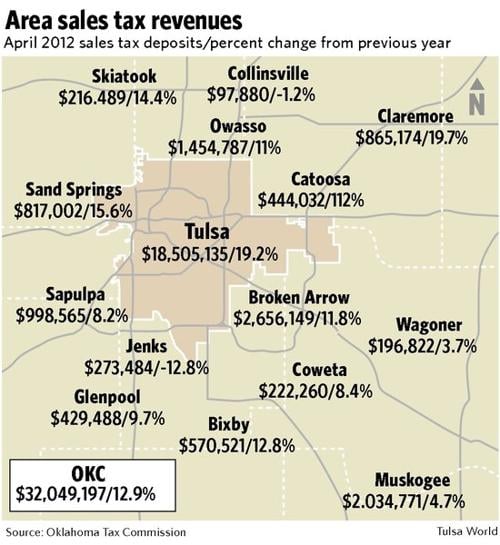

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

Total Sales Tax Per Dollar By City Oklahoma Watch

Sales Tax Exemption Letter For Oklahoma State Gov T Entities